Доля импортных строительных материалов на украинском рынке выросла с 14% в 2021 году до 23% в 2023 году, отечественный рынок…

Market comment

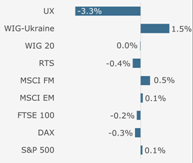

The Ukrainian Exchange was by far the worst performing index in the EMEA space yesterday, according to Bloomberg, as equity markets across the globe stumbled as concern grew about China and Europe. China’s purchasing managers’ index fell to 53.7 in August, its lowest mark since March 2011, signaling a slowedown in non-manufacturing industries while Spain’s prime minister denied he planned to ask for a bailout soon. The UX dropped 3.3%, notably worse than both the benchmark MSCI FM (+0.5%) and MSCI Europe (-0.2%) and neighboring Russia’s RTS (-0.4%). All 10 local blue chips were in the red. Meanwhile, Poland’s WIG-Ukraine index kept marching upward, adding 1.5% to bring its modest three-day rally to 3.0%. Westa (WES PW) remained in the spotlight, bidded up another 11.6% yesterday. Kernel (KER PW) rose 3.2% following the announcement of a 50/50 joint bid with Glencore (GLEN LN) to acquire a deep water grain terminal in Russia. One of the day’s biggest movers was Bank of Georgia (BGEO LN), which fell as low as GBp 1,175 before closing down 6.6% to GBp 1,183, its lowest level since early September, on political jitters as the status quo was unexpectedly thrown in flux. Georgian Mikheil Saakashvili conceded defeat in Sunday’s parliamentary election yesterday; his political party will now move into opposition in parliament. We expect a weaker open again today for Ukrainian equities; Asian and Russian bourses are continuing to fall this morning and European futures are down.

Источник: Конкорд Капитал

- MARKET COMMENT Конкорд Капитал 26 січня 2018 года

- MARKET COMMENT Конкорд Капитал 25 січня 2018 года

- MARKET COMMENT Конкорд Капитал 24 січня 2018 года

- MARKET COMMENT Конкорд Капитал 23 січня 2018 года

- MARKET COMMENT Конкорд Капитал 22 січня 2018 года